Content

The annual report also discusses market conditions and investment strategies that significantly affected the fund’s performance during its last fiscal year. By subtracting the cash and stock dividends from the net income, the formula calculates the profits a company has retained at the end of the period. If the result is positive, it Statement Of Shareholders Equity Definition means the company has added to its retained earnings balance, while a negative result indicates a reduction in retained earnings. A Statement of Stockholders’ Equity is a required financial document issued by a company as part of its balance sheet that reports changes in the value of stockholders’ equity in a company during a year.

Shareholders’ equity (SE) is the residual interest in a company’s assets after deducting its liabilities. Paid-in capital is the amount of money that investors have put into the company. Retained earnings are the profits the company has generated over time that have not been paid out as dividends to shareholders. SE is an important measure of a company’s financial health because it represents the funds available to creditors and investors in the event of a liquidation. Stockholders’ equity is the money that would be left if a company were to sell all of its assets and pay off all its debts.

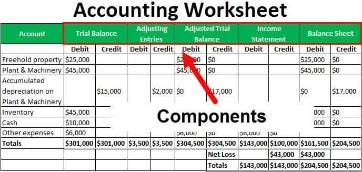

AccountingTools

The D/E ratio is especially important for a business using debt financing to raise more capital. Equity financing is an incredibly popular method for businesses looking to expand quickly. Understanding how much shareholder equity is already committed to a business is a useful metric for potential investors. Bank loans also often reference the D/E ratio when determining whether a loan is approved or denied, as well as how much capital the loan is worth. The debt-to-equity ratio (D/E ratio) shows how much debt a company has compared to its assets. A higher D/E ratio means the company may have a harder time covering its liabilities.

Shareholders’ equity, or simply equity, is the net worth of a company that would remain if all its assets were sold and all its liabilities paid off. The “Treasury Stock” line item refers to shares previously issued by the company that were later repurchased in the open market or directly from shareholders. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased). The market value of equity is a byproduct of the current share price, as well as the total number of diluted shares outstanding.

Create a free account to unlock this Template

For mature companies that have been consistently profitable, the retained earnings line item can contribute the highest percentage of shareholders’ equity. In these types of scenarios, the management team’s decision to add more to its cash reserves causes its cash balance to accumulate. If shareholders’ equity is positive, that indicates the company has enough assets to cover its liabilities. But in the case that it’s negative, that means its debt and debt-like obligations outnumber its assets. This formula takes into consideration the capital that was paid for shares, added to the retained earnings minus the treasury shares, which the company had previously issued, but repurchased. Statement of Shareholders’ Equity is used to calculate the company’s book value per share.

- The statement of shareholders’ equity includes information about the company’s beginning shareholders’ equity, changes in shareholders’ equity during the reporting period, and the company’s ending shareholders’ equity.

- For example, if a company reports $10,000,000 in net profits for the quarter and pays $2,000,000 in dividends, it increases stockholders’ equity by $8,000,000 through the retained earnings account.

- We can cross-check each of the formula figures used in the retained earnings calculation with the other financial statements.

- These earnings are considered “retained” because they have not been distributed to shareholders as dividends but have instead been kept by the company for future use.

This equation is necessary to use to find the Profit Before Tax to use in the Cash Flow Statement under Operating Activities when using the indirect method. This is used whenever a comprehensive income statement is not given but only the balance sheet is given. Therefore, debt holders are not very interested in the value of equity beyond the general amount of equity to determine overall solvency. Shareholders, however, are concerned with both liabilities and equity accounts because stockholders equity can only be paid after bondholders have been paid.

Protect Your Company’s Equity Now

A statement of stockholders’ equity is another name for the statement of shareholder equity. This section of the balance sheet is also known as a statement of shareholders’ equity https://kelleysbookkeeping.com/ or a statement of owner’s equity. It gives shareholders, investors or the company’s owner a picture of how the business is performing, net of all assets and liabilities.

Companies that offer and sell securities to the public in reliance on an exemption from registration for securities-based crowdfunding must make filings on EDGAR. SEC correspondence – The publicly released written correspondence from the SEC staff to the company during a review process, including a review of a company’s registration statement for its initial public offering. Business Combinations

Depending on how a merger or acquisition is structured, different types of filings may be required by the companies involved in the transaction. Common form types filed in connection with a business combination include the following.

Current liability comprises debts that require repayment within one year, while long-term liabilities are liabilities whose repayment is due beyond one year. Where the difference between the shares issued and the shares outstanding is equal to the number of treasury shares. Finally, the number of shares outstanding refers to shares that are owned only by outside investors, while shares owned by the issuing corporation are called treasury shares.